Simple, Transparent Pricing.

Find the plan that's right for you.

Find the plan that's right for you.

Pay As You Go

2.2% + 25¢

Credit & Debit Cards

- eCheck 35¢ per transaction

- Pay as you go flat rate

- No setup, monthly, or hidden fees

- Dedicated support

Interchange Cost-Plus

0.20% + 25¢*

Credit & Debit Cards

- eCheck 25¢ per transaction

- $9.99 per month

- No setup or hidden fees

- Dedicated support and account management

Request for Proposal

Thank you for your interest in Karma Payments' merchant service program. Please take a few moments to complete this form. Documents can be faxed or emailed if needed to clarify your request. This application only accepts qualified proposal requests for Karma Payments' services. All other inquires should be directed to our Contact Us page.

Check Verification

Take the risk out of accepting checks. Leverage the advanced scoring and decision capabilities of our dynamic risk engine; it tracks the check writing history of 98 percent of all U.S. point-of-sale check writers. With Karma Payments' verification service, confidently accept more checks while reducing bank fees and processing costs.

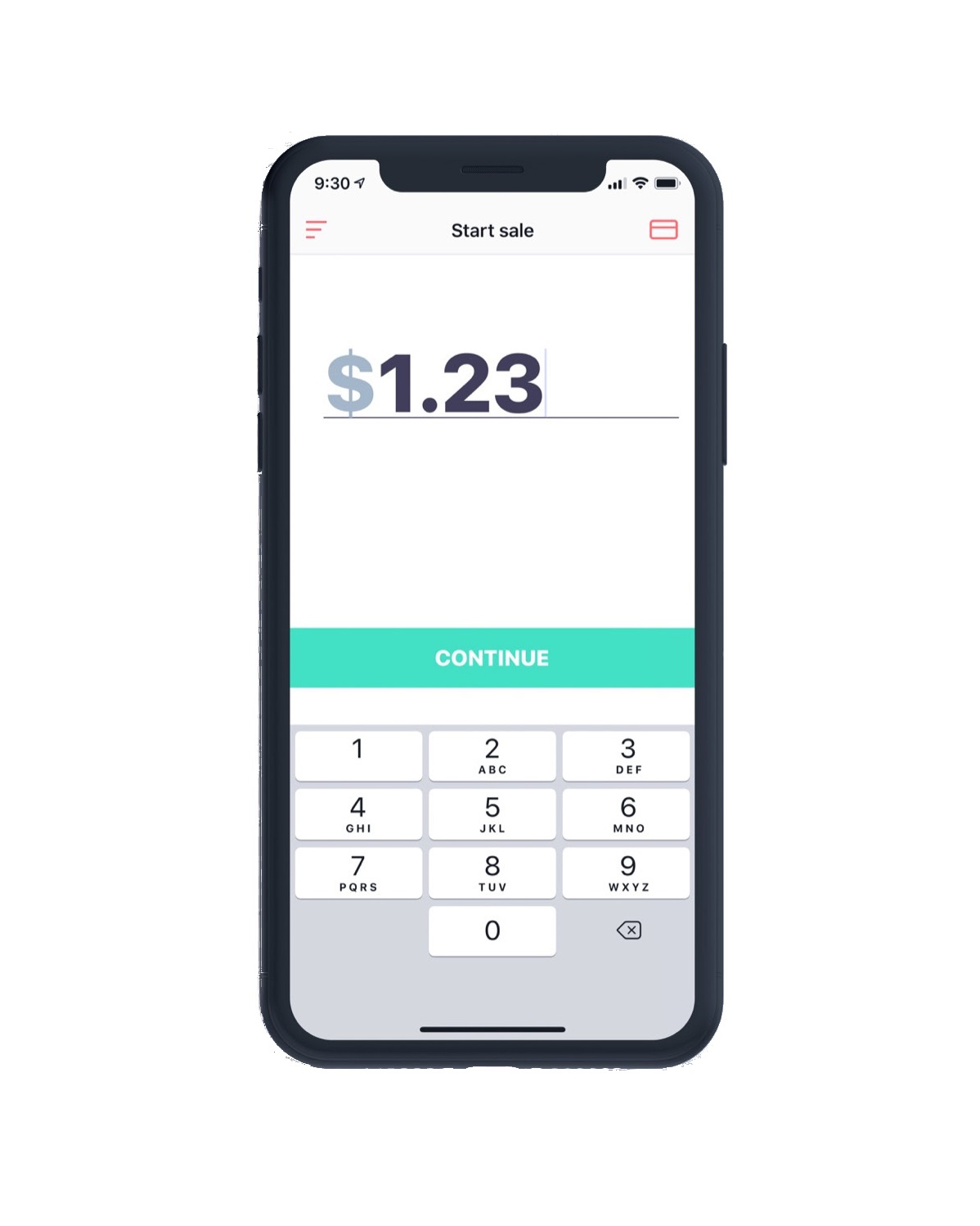

Mobile

No matter how your customer is paying — EMV® chip, swipe, or with their mobile device, Mobile Karma can take it. This tiny device is packed with possibility. With the Mobile Karma solution, you receive intuitive reporting on sales activity, business insights, and more.

Account Updater

Credit and debit card numbers change for a variety of reasons including card expiration, card product type upgrades, portfolio conversions, and compromised account numbers. For organizations that offer services billed on a recurring or installment basis, out-of-date payment information can result in lost revenue, involuntary churn, and decreased customer satisfaction. The Account Updater service shifts the workload of obtaining and maintaining updated account information to us. Utilizing configurable scheduling algorithms, we initiate account update requests on your behalf. We then store the updated card information for use in future transactions. You simply submit billing transactions normally and, if necessary, we update the transaction with the stored card information before sending it to the networks for authorization. This fully managed service requires no code update on your systems.

Level 2/3 Data

When transactions involve business or government entities using purchasing cards, you can obtain a significantly better interchange rate by including additional data with the transaction. This data is referred to as Level 2 or Level 3 data. You can include this data in any of the following transaction types: Authorization, Capture, Capture given Auth, Credit, or Sale.

3DS Authentication

The 3DS (3-D Secure) protocol adds a layer of security to merchants for online credit and debit card transactions. Initially developed by Visa and offered under the name of Verified by Visa (MasterCard provides a similar service named MasterCard Secure Code), this service adds an authentication step to the process of purchasing goods/services online. When a consumer submits an order on your website, they are redirected to a website maintained by the issuing bank. On this site, they enter a password/code to authenticate they are the cardholder. Upon confirmation of the password/code, the issuing bank returns an authentication code and transaction ID.